With the most favorite time of year right around the corner, it’s time to start planning your Christmas budget (if you haven’t already).

According to LendingTree, a third of Americans accumulated an average of $1249 of holiday debt last Christmas 2021. The sad thing is many are probably still paying for those credit cards.

With 0% financing offers and buy-now-pay-later programs, it’s so easy to fall into the debt trap. Once Upon a time, I was one of these people. I love Christmas, and I love giving gifts. But, my generous ways were digging me further into debt every year.

Thankfully I had a change in mindset about my spending and realized, like the Grinch, Christmas is more than presents!

“Maybe Christmas (he thought) doesn’t come from a store. Maybe Christmas…perhaps…means a little bit more.”

-The Grinch

Therefore, I wanted to discuss how to budget for Christmas so you can have a festive holiday without debt.

Related: 5 Secrets To Master Your Money Mindset

Disclaimer: This post may contain affiliate links. This means I receive a small commission, at no extra cost, if you purchase using the links below. Please see my earnings disclaimer for more details.

Table of Contents

How to budget for Christmas?

First, let’s talk about a Christmas budget. A Christmas budget is just a regular budget, specifically for the Christmas holiday. It includes your spending for the entire holiday season (activities, parties, food, and gifts). All things Christmas!

Therefore, to create a Christmas budget, you need to estimate and determine your spending for the holiday season. Figure out the who, what, and where of your Christmas spending. Things to consider when making your holiday budget are:

- Who are you buying for (kids, extended family, teachers, friends, etc.)?

- Do you need any holiday decorations?

- What events do you plan on hosting or going to?

- What are you doing for Christmas dinner?

- Are you sending Christmas cards?

- Do the kids have holiday activities at school?

- Is this a realistic Christmas budget?

Break down your budget into different categories so you know how much you have to spend.

Our Christmas Budget

| Category | Budgeted Cost |

| Christmas Eve boxes (pjs, popcorn, snacks, book) | $75 |

| Christmas cookies | $30 |

| Christmas Dinner | $75 |

| Christmas Gifts | $750 (hopefully less) |

| Pictures with Santa | $25 (possibly free) |

| Christmas Light Extravaganza (Free plus $35 carriage rides) | $35 |

| Parade | Free |

| Total | $990 |

Then, make sure to track your spending with each purchase. This way, you know how much is left within each category.

Related:

How To Create A Zero-Based Budget To Simplify Your Finances

12 Important Reasons and Benefits of Tracking Your Expenses

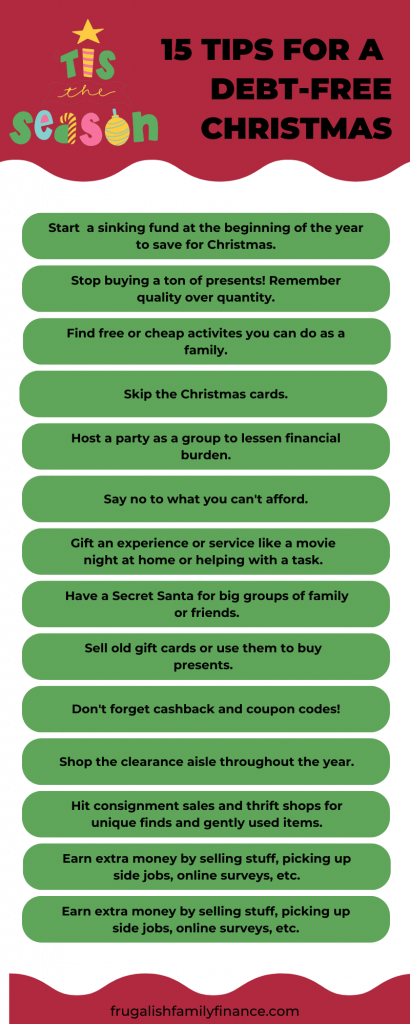

15 Tips to stay out of debt this Christmas

Now let’s talk about how to have a debt-free Christmas.

Start a sinking fund

A sinking fund is a savings account dedicated to something you’re saving for, like Christmas, vacation, or back to school.

Ideally, a Christmas sinking fund works best if you start in January or the beginning of the year, so you’re not scrambling last minute for funds or taking on credit to pay for Christmas.

To create a sinking fund, you need to figure out how much and how often you want to save. To do this, you can choose an amount monthly, or you can divide the amount by the number of paychecks you have before holiday spending.

For example, if I have six paydays until I need to spend $500, I would save $83 every paycheck.

Related:

Everything You Need To Know About Sinking Funds For Beginners

23 Sinking Fund Categories to Help You Budget Better

Stop with all the presents!

This one is so hard! Christmas was always a big deal growing up. My parents didn’t have a ton of money (plus they had four kids), but they always did a huge Christmas because it was a special occasion.

It may not have even been that big, but it was amazing as a kid! I want that experience for my children as well. But I have realized they’ll remember the experience and the love more than chunks of plastic.

Plus, the more toys your kids have, the more chaotic the house is. Instead, take a more minimalist approach when it comes to Christmas presents. Here are some fun gift rules that are becoming more popular.

- The 3-gift rule: you buy three gifts to include something they want, something they need, and something to read.

- The 4-gift rule: you buy four gifts to include something they want, something they need, something to wear, and something to read.

Focus on quality instead of quantity. I don’t know how many toys my kids have received and broke within the first week or two.

Find free or cheap activities

You don’t have to spend a ton to get into the holiday spirit. There are so many activities to do as a family on a tight budget. Here are ten of our favorite Christmas activities that cost little or no money.

- Go to local parades

- Pictures with Santa (it doesn’t have to be the expensive pictures at the mall)

- The local library has tons of acitivites and events

- Most towns have a Christmas event

- Drive around and look at the Christmas decorations and lights

- Christmas movie marathon

- Decorate the Christmas tree

- Make homemade Christmas decorations

- Homemade Christmas gifts

- Make Christmas cookies

Skip the Christmas cards

Christmas cards are a festive tradition that is fun to receive but can be pretty costly, depending on your Christmas card list.

Although I love Christmas cards, I chose to do away with this tradition because…

- I just don’t have the time to make out that many cards.

- It’s a waste of money to me.

But, if you happen to be a Christmas card person (a lot of people are), there are several ways to save money.

- DIY your own Christmas cards or postcards.

- Buy cards after Christmas when they go on sale or buy for cheap from thrift stores or yard sales.

- Shorten the list of people you send cards to.

- Send an email with a family photo instead.

Host a group party or potluck

Hosting can be costly (and stressful)! Instead of hosting by yourself, have a potluck Christmas or invite close friends or family to help you plan and split the responsibilities. This way, the sole financial burden isn’t on you. It will be more fun, less stressful, and way cheaper.

Give homemade gifts

Save money on Christmas shopping for extended family and friends by making homemade gifts. My family had a homemade Christmas a couple of years ago; these were some of my all-time favorite gifts!

Homemade gifts are more thoughtful than a piece of plastic, and they can be pretty inexpensive to make. Here are some great homemade gifts ideas.

- Vanilla extract (super easy to make)

- Seasonings or dip mixes

- Baked goods (breads, cookies, fudge, things dipped in chocolate!)

- Home decor

- Cocoa bombs

Pinterest has tons of gift ideas that don’t suck and that people would actually appreciate. You don’t have to spend much money to give a thoughtful gift.

Related: 56 Totally Awesome Last Minute Cheap DIY Christmas Gifts

Just say NO!

The first year we started the baby steps, we were so freaking broke. We decided to tell everyone we just couldn’t afford to get all the extended family gifts.

Everyone was completely fine with it. And you know what? It relieved a financial burden from all of us because we were all broke as hell.

Related:

Dave Ramsey’s 7 Life-Changing Financial Baby Steps

How to Slay Your Debt Using the Debt Snowball

Gift an experience or service

So, instead of giving gifts that year, we decided to plan a fun experience for when we got together that summer. Time is the most important and valuable gift you can give.

Therefore, it doesn’t have to cost a lot. Maybe it’s a homemade charcuterie board, wine, and a movie at home with your sister. Or helping a friend clean their garage or do laundry.

An experience is also an awesome idea for grandparents in lieu of toys because they have enough (for the love of God)!

Have a Secret Santa

If you have a big extended family or group of friends, try a Secret Santa instead of buying individual gifts for everyone. Put everyone’s name in a hat, and each person picks a name to buy for.

My family does drawing for the kids and one for the adults. We put a spending limit on it, usually $20-25. Then, we pick a day to exchange gifts. It’s fun and saves everyone a lot of stress and money!

Use gift cards

Sometimes we have gift cards to places we don’t usually shop at. You could use these gift cards to purchase gifts. Or, you could sell them.

Buying discounted gift cards are a great way to save money. Buy the gift card at a discounted rate, and then use it to buy your Christmas presents. Here are some sites where you can sell or buy discounted gift cards.

Use cashback sites and discount codes

I love a good deal! Cashback and discount code apps are a great way to save on items you need or want to buy. I have significantly saved by pairing cashback/discount codes with store sales. Here are the apps/sites I use the most.

Shop Black Friday/Cyber Monday sales

If you’re a last-minute shopper (like I am), Black Friday is a great time to pick up the things you need for Christmas. I found that they offer the same deals online as in the store most times, so there is no need to get up early or venture out on Thanksgiving Day.

Cyber Monday (the Monday after Thanksgiving) is also an excellent day to find deals.

The Black Friday and Cyber Monday ads usually start appearing in mid-October. Use the ads to devise a plan for the things you need to buy for Christmas.

Buy clearance items throughout the year

Another awesome idea to stay on budget is to pick up items in the clearance aisles throughout the year.

After Christmas is a great time to stock up on things like…

- wrapping paper

- Christmas cards

- packing supplies

- holiday gift baskets (for next year, depending on if they have an expiration)

- household goods that are Christmas decorated (you can still use soap, paper plates, and such throughout the year)

Also, if you browse the clearance aisle, you can usually find good-quality toys and such throughout the year.

Shop consignment sales

Consignment sales and online markets (Poshmark, Mercari, and eBay) are great places to pick up gently used or new items for a fraction of the original price.

Don’t rule out your local thrift store; you can find unique things and great deals too!

Make extra money

Last thing, it’s not too late to start saving if you feel you’re behind the Christmas curve. Some ways to help you earn extra money for Christmas are…

- Declutter and sell some stuff (Poshmark, eBay, garage sale, Facebook Marketplace)

- Donate plasma

- Pick up a side hustle (walking dogs, cleaning houses, handyperson tasks)

- Online surveys (Survey Junkie, Inbox Dollars, Mypoints, and Swagbucks)

Conclusion

The Christmas season can be a very costly time of year. Make sure to create a budget for your holiday expenses, be smart about spending, and say no to things you can’t afford. Don’t spend the new year paying off this year’s Christmas credit card debt.

Make sure to grab your FREE Christmas Budget below!

I’m getting ready to start my Christmas shopping, so this post was very helpful!

Agreed! I love Christmas but the pressure to buy and host gets to be a lot. I like the idea of homemade gift or limiting the number of bought gifts. I’m trying to buy ahead but I find it hard to know what to get so long in advance but it is a good way to benefit from sales. Great ideas, thank you for sharing!

Seriously such a helpful post! Love the cheap/free activity and homemade gift ideas!

This is so great. We have a Christmas sinking fund, but the only thing I budgeted for was presents. I forgot about all the extra meals and cookies and cards… I need to adjust that. Looks like I’ll be making some gifts this year. This was very helpful.

Love this! Christmas can end up SO expensive if you aren’t careful with a budget! Great tips!

Great ideas! I have been trying to do more of the buy throughout the year on sale this year.

Great info!

I love this! Christmas can have so much pressure to spend so much. I really appreciate your ideas. Thank you for sharing!

Christmas can be such a stressful time for many families. Thank you for the tips!

Love these ideas since Christmas gets out of hand most years!

Love this post because it gives so many different ways to celebrate without going overboard. I’m retired on a fixed income and now trying to buy for grandkids. It’s easy to get carried away, but they really do have so much already. I wasn’t aware of some of the cashback sites and definitely agree with making simple gifts. Thank you so much for all the great information!

Thank you! Glad you liked it and found it helpful. I know it’s hard for grandparents because they want to spoil their grandkids, but all the stuff is so overwhelming for the kids and parents. I love the idea of an experience or practical gifts. Thanks for reading!

Great tips! Christmas spins out of control so quickly!

Thank you for the great tips. As our family has grown over the years, we hold a white elephant party every year. $10.00 funny gift per person, for the party and potluck dinner. We enjoy our time together instead of racking up debt.

I love this!

I love the tip of buying discounted items off-season. I always take advantage of buying wrapping paper and such after Christmas for the next year! I also haven’t tried cash-back apps much but I’m going to give it a go!